The annual Halloween events in Hong Kong’s two theme parks, namely Ocean Park Halloween Bash and Hong Kong Disneyland Dark World, are some of the most popular events in the city. Indeed, the two parks are keen rivalries, and Halloween is a major platform of their competition. In 2010, Ocean Park launched 6 online display ad campaigns with 50+ creative used, and the ad spend was approximately $850 thousand, while Disneyland run 4 online display ad campaigns, including a Halloween Special buffet promotion, with 30+ creative and the ad spend was around $600 thousand.

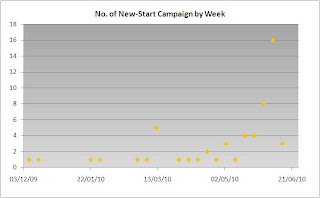

Chart 1: Halloween Online Display Ad Campaigns by Theme Parks

Graph 1: Disney and Ocean Park Halloween Online Display Ad Campaign List

Both theme parks were more focus on the mass market that revealed in their selections on publishers for their Halloween display ad campaigns. Disneyland was comparatively target to families, and it spent the most on TVB.com for their campaigns. Whilst Ocean Park were keen in young mass market; therefore, on the top 5 publisher list by ad spend, apart from Yahoo!HK, Discuss.com.hk, Uwants and MSN Buddy List were found.

Chart 2: Top 10 Publishers for Halloween Display Ad Campaigns by Theme Parks

To discover the prompt and proactive opinions of the consumers on these major events on Consumer Generated Media (CGM, including forums, blogs, newsgroup and online instant news), a comparison between the two parks was made with digital word-of-mouth (WOM) monitoring, covering the period from 1 September to 5 November in Hong Kong and Macau.

Chart 3: Online Ad Word-of-Mouth on Halloween Campaign by Theme Parks

In this case of the Halloween campaigns, Ocean Park had a larger campaign exposure among netizens. Around 700 topics with 1,500 posts related to Disneyland Dark World were found on 30 websites, viewed by more than 800 thousand people, while 3,000 topics with 13,000 posts about Ocean Park Halloween Bash were found on 50 websites, viewed by over 2.3 million people.

An overall view of the period shows that the peak of online discussions about the Halloween events appeared during the weekends. The average sentiment indexes, generated from the comments in the discussions, were positive of both theme parks’. It fluctuated from -10.5% to 81.6% for Disneyland; while that was from neutral (0.00%) to 43.5% for Ocean Park.

About half of the CGM was found in Uwants and HKGolden, in which two out of the top 3 websites by post count, were considered as a hub of discussions/ opinions from juveniles and young adults, i.e. Uwants and 3boys2girls. The top 10 websites also showed the potential market in Macau for the Halloween promotions.

Chart 4: Top 10 Websites of CGM from Theme Parks Halloween Promotions by Post Count

The discussions mainly focused on experience sharing, including topics such as compliments of the night show in Disneyland and comparisons between the two parks. For Disneyland, the most discussed topics were positive opinions of the Halloween night show and the costumes of the Disney characters, and ways to deal with Mainland visitors in the park. On the other hand, the top topics concerning Ocean Park were comparisons of scariness of the amusements with that of Disneyland, comments on the new haunted houses, and ways to visit all the haunted houses in a limited time.

The popularity of the Halloween events held by the two theme parks in Hong Kong was affirmed. Netizens discussed a lot about the events and their comments were generally positive. Moreover, by comparing the data concerning Ocean Park Halloween Bash and Disneyland Dark World, it was found that the event of Ocean Park was more preferable to the netizens than that of Disneyland. As a matter of fact, the topics and posts on CGM serve as revealing evidence of consumers’ preference and feedback, for people are able to express their views and opinion freely and instantly on these sites.

Notes:

1. Figures rounded to the nearest digit

2. Source from Admomo and K-Matrix

(adWOM is a competitive monitoring tool for experienced marketers powered by Admomo and K-Matrix. It monitors online display ad campaigns, as well as online noise with consumers’ instant feedbacks towards the promotions and advertised products. For more details, please email to sales@admomo.com )